When most people hear “Samsung,” they think of Galaxy smartphones. Big screens, sharp cameras, premium Android phones. But behind the scenes, something surprising is happening. Samsung’s memory business is now almost as large as its Galaxy smartphone division. And honestly, that changes how we should look at the company.

Samsung is not just a phone brand anymore. In many ways, it is a backbone company for the global tech industry.

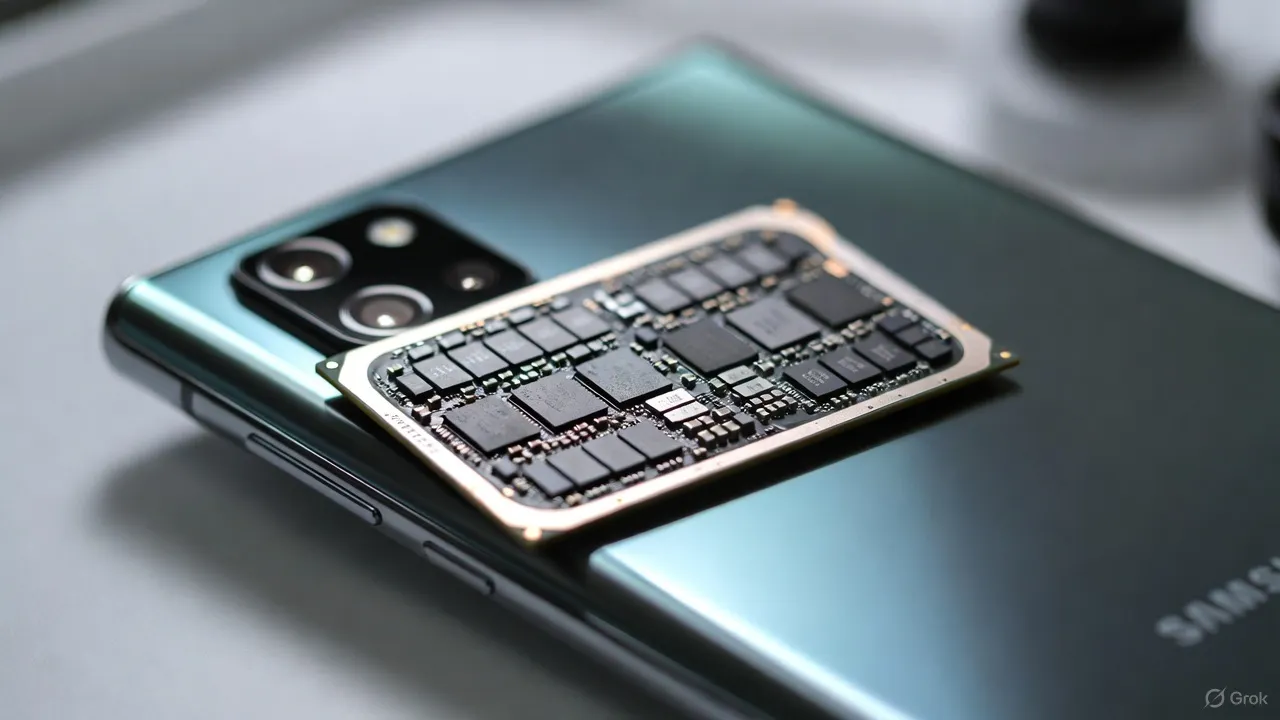

The quiet giant behind modern technology

Samsung is the world’s largest producer of memory chips, including DRAM and NAND flash. These are the tiny components that power smartphones, laptops, servers, data centers, electric cars, and now AI systems. Every time you open an app, stream a video, or ask an AI tool a question, memory chips are working in the background.

What makes this interesting is scale. Revenue from Samsung’s memory division has grown so much that it is now nearly matching the Galaxy smartphone business. Phones may be what consumers see, but memory is where the long-term demand is exploding.

Why memory demand is booming right now

There are three big forces pushing this growth.

First is AI. Artificial intelligence models require massive amounts of high-speed memory to process data quickly. Samsung supplies advanced memory to companies building AI servers and cloud platforms.

Second is data centers. Streaming, cloud storage, and enterprise software all depend on reliable memory chips. As the world creates more data, memory demand rises with it.

Third is diversification. Smartphones are a mature market. Growth is slower and competition is intense. Memory, on the other hand, is used everywhere. From cars to smart factories, memory is becoming essential infrastructure.

Galaxy phones still matter, but the balance is shifting

Galaxy smartphones remain hugely important to Samsung’s brand and profits. They drive consumer loyalty and global visibility. But phones are also vulnerable to economic slowdowns and market saturation. Memory chips help balance that risk.

This is why investors and industry analysts pay close attention to Samsung’s semiconductor division. It provides stability when phone sales slow down, and upside when tech cycles turn positive. It is a smart hedge, frankly.

What this means for Samsung’s future

Samsung is positioning itself less as a phone company and more as a full-spectrum technology supplier. Memory, logic chips, displays, batteries, and consumer devices all working together.

That strategy builds long-term trust. Governments, enterprises, and AI companies want suppliers that can scale, innovate, and deliver reliably. Samsung fits that profile.

So yes, Galaxy phones are still iconic. But the real power of Samsung today sits quietly inside servers, data centers, and devices you never open.

Most people don’t notice memory chips. But Samsung’s memory business being nearly as big as Galaxy is a signal. The future of tech is less about what you hold in your hand, and more about what works invisibly behind it.